Patrocinados

- 12 Entradas

- 2 Fotos

- 0 Videos

- Female

- 12/01/1994

- seguida por 6 people

Actualizaciones Recientes

- Where can I get the cheapest Health insurance on Texas?

https://txmedsolutions.com/

When it is about health insurance in Texas or for that matter, any state, there is nothing like the cheapest. It all depends on your budget and health care needs, since this is the only way to ensure that your health insurance, including Medicare health plan in Texas, serves its real purpose.

Depending on your health status, a health plan with higher premiums may save you a lot of dollars in the long run. On the contrary, a relatively inexpensive health insurance may cause you to pay a hefty sum of money from your own pocket for various health care services in a given enrollment year. So, rather than looking for the cheapest option, it is best to find one which meets your health-specific needs and suits your pocket at the same time.

To help you choose the right one for you, here are four “metal” categories of health insurance plans for you to consider: Bronze, Silver, Gold, and PlatinumWhere can I get the cheapest Health insurance on Texas? https://txmedsolutions.com/ When it is about health insurance in Texas or for that matter, any state, there is nothing like the cheapest. It all depends on your budget and health care needs, since this is the only way to ensure that your health insurance, including Medicare health plan in Texas, serves its real purpose. Depending on your health status, a health plan with higher premiums may save you a lot of dollars in the long run. On the contrary, a relatively inexpensive health insurance may cause you to pay a hefty sum of money from your own pocket for various health care services in a given enrollment year. So, rather than looking for the cheapest option, it is best to find one which meets your health-specific needs and suits your pocket at the same time. To help you choose the right one for you, here are four “metal” categories of health insurance plans for you to consider: Bronze, Silver, Gold, and PlatinumTXMEDSOLUTIONS.COMHomeLooking for the best Medicare Health Plans in San Antonio, TX? Texas Medicare Solutions has you covered! Call (210) 908-6565 to speak to an agent today!0 Commentarios 0 Acciones 218 Views 0 Vista previaPlease log in to like, share and comment! - Aetna Texas Health InsuranceHumana vs. Aetna Humana and Aetna are two renowned health insurance companies in the United States. If you have to choose any one of the two quickly, you will probably zero in on Humana if you are one the lookout for a health insurer that is present in almost all the states of our country. Moreover, Humana enjoys an A- rating for financial health from AM Best. Similarly, opting for Aetna...0 Commentarios 0 Acciones 711 Views 0 Vista previa

- https://txmedsolutions.com/medicare-advantage-plans-and-prescription-drug-plans-type-costs-provider-choices-more/TXMEDSOLUTIONS.COMMedicare Advantage Plans and Prescription Drug Plans – Type, Costs, Provider Choices & MoreLooking for the best Medicare Health Plans in San Antonio, TX? Texas Medicare Solutions has you covered! Call (210) 908-6565 to speak to an agent today!0 Commentarios 0 Acciones 239 Views 0 Vista previa

- Which is better, a free Medicare Advantage plan or a Medicare Supplement plan costing $2,500 year?

https://txmedsolutions.com/our-products/medicare-advantage/

Both Medicare Supplement and Medicare Advantage are great option to get your Medicare coverage. You can qualify for both Medicare Supplement (Medigap) and Medicare Advantage (or Medicare Part C) only if you qualify to enroll in Original Medicare. But, remember that you cannot have both simultaneously. This means, if you have enrolled yourself in a Medigap policy, you cannot enroll in a Medicare Advantage in San Antonio in the very same year. However, you can switch plans next year, usually during the Open Enrolment Period. To determine which of the two is better for you, it is important to understand the basic differences between Medigap and Medicare Advantage.

Medicare Advantage (MA) plans replace Original Medicare (Part A and Part B). When you buy a Medicare Advantage in San Antonio, it is your insurance company (and not Medicare) provides all your health benefits and coverage. So, you don’t lose any Original Medicare benefits. In fact, most MA plans include extra benefits like routine vision and dental care, and almost all MA plans include Medicare Part D prescription drug coverage.

On the other hand, Medicare Supplement (Medigap) plans complement Original Medicare. These plans cover the bulk of your out-of-pocket expenses with Medicare Part A and Part B. While you will still get your coverage from Medicare, your Medigap plan will pay your coinsurance and deductible. Usually, you don’t get any additional benefits with a Medigap plan. If Original Medicare doesn’t cover a health care service, your Medicare Supplement plan will also not cover the same. Medigap plans also don’t pay your out-of-pocket costs with Part D prescription drug plan, and you will solely be responsible for the associated coinsurance and deductible.Which is better, a free Medicare Advantage plan or a Medicare Supplement plan costing $2,500 year? https://txmedsolutions.com/our-products/medicare-advantage/ Both Medicare Supplement and Medicare Advantage are great option to get your Medicare coverage. You can qualify for both Medicare Supplement (Medigap) and Medicare Advantage (or Medicare Part C) only if you qualify to enroll in Original Medicare. But, remember that you cannot have both simultaneously. This means, if you have enrolled yourself in a Medigap policy, you cannot enroll in a Medicare Advantage in San Antonio in the very same year. However, you can switch plans next year, usually during the Open Enrolment Period. To determine which of the two is better for you, it is important to understand the basic differences between Medigap and Medicare Advantage. Medicare Advantage (MA) plans replace Original Medicare (Part A and Part B). When you buy a Medicare Advantage in San Antonio, it is your insurance company (and not Medicare) provides all your health benefits and coverage. So, you don’t lose any Original Medicare benefits. In fact, most MA plans include extra benefits like routine vision and dental care, and almost all MA plans include Medicare Part D prescription drug coverage. On the other hand, Medicare Supplement (Medigap) plans complement Original Medicare. These plans cover the bulk of your out-of-pocket expenses with Medicare Part A and Part B. While you will still get your coverage from Medicare, your Medigap plan will pay your coinsurance and deductible. Usually, you don’t get any additional benefits with a Medigap plan. If Original Medicare doesn’t cover a health care service, your Medicare Supplement plan will also not cover the same. Medigap plans also don’t pay your out-of-pocket costs with Part D prescription drug plan, and you will solely be responsible for the associated coinsurance and deductible.TXMEDSOLUTIONS.COMMedicare AdvantageLooking for the best Medicare Health Plans in San Antonio, TX? Texas Medicare Solutions has you covered! Call (210) 908-6565 to speak to an agent today!0 Commentarios 0 Acciones 228 Views 0 Vista previa - Aetna vs. Amerigroup

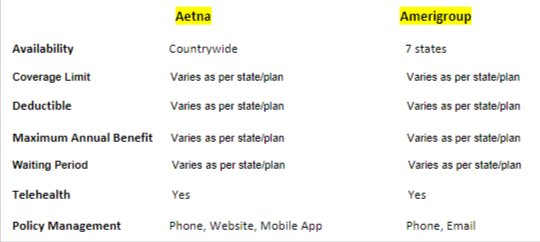

Aetna and Amerigroup are two of the top health insurance providers in the United States. If you are to select one of them quickly, you'll probably go for Aetna if you qualify for Medicare. Similarly, Amerigroup will seem like a better option if you are looking for a health insurer with more plan options. Also, Amerigroup has the backing of one of the biggest health insurers in the country.

However, selecting a health policy is a decision that cannot be taken in haste. You need to analyze and consider all the main factors, including your key requirements. The comparison given below between Aetna and Amerigroup can let you figure out which of the two alternatives will come in handier in fulfilling your needs

Contact us now if you would like to enroll in any of Aetna individual health insurance plans or Amerigroup health insurance or Medicare advantage plans in Texas. We can easily bring you into contact with Amerigroup or Aetna Medicaid providers in Texas.

Know More Here-

Aetna Health Insurance: https://txmedsolutions.com/our-insurance-carriers/aetna/

Amerigroup Health Insurance: https://txmedsolutions.com/our-insurance-carriers/amerigroup/Aetna vs. Amerigroup Aetna and Amerigroup are two of the top health insurance providers in the United States. If you are to select one of them quickly, you'll probably go for Aetna if you qualify for Medicare. Similarly, Amerigroup will seem like a better option if you are looking for a health insurer with more plan options. Also, Amerigroup has the backing of one of the biggest health insurers in the country. However, selecting a health policy is a decision that cannot be taken in haste. You need to analyze and consider all the main factors, including your key requirements. The comparison given below between Aetna and Amerigroup can let you figure out which of the two alternatives will come in handier in fulfilling your needs Contact us now if you would like to enroll in any of Aetna individual health insurance plans or Amerigroup health insurance or Medicare advantage plans in Texas. We can easily bring you into contact with Amerigroup or Aetna Medicaid providers in Texas. Know More Here- Aetna Health Insurance: https://txmedsolutions.com/our-insurance-carriers/aetna/ Amerigroup Health Insurance: https://txmedsolutions.com/our-insurance-carriers/amerigroup/0 Commentarios 0 Acciones 265 Views 0 Vista previa - Get the Lowdown on Vision InsuranceVision insurance can be described as a health plan aimed at making eye examinations and prescribed eyewear cheaper. Some vision insurance schemes even offer rebates on LASIK and other vision-related surgeries. Traditionally, vision insurance was introduced to provide coverage for products and services that comprise preventive eye care and cover the costs of eye conditions and injuries. Vision...0 Commentarios 0 Acciones 749 Views 0 Vista previa

- Comparison Between Aetna And Blue Cross Blue ShieldAetna and Blue Cross Blue Shield are counted amongst two of the best health insurers in the United States. If you were to quickly choose one of them, you would probably opt for Aetna if you are eligible for Medicare. Similarly, you'll be more inclined to consider Blue Cross if you are on the lookout for a private health plan. Also, Blue Cross's network is slightly bigger than that of Aetna....0 Commentarios 0 Acciones 814 Views 0 Vista previa

- https://txmedsolutions.com/our-products/life-insurance/

There are different parameters on the basis of which you can compare the health insurance plans that are available in your area and some of them are as follows:

Coverage

You basically need to choose a health insurance policy that provides coverage against maximum number of medical problems. Your health plan must also consist of benefits such as cashless treatment, transportation, pre and post hospitalization charges, daycare costs, etc.

Renewability

When you decide to buy a health plan, you need to take note of its lifespan i.e. the number of years for which it will serve you. A health insurance policy with lifetime renewability works best for it's in your latter years that you need your health insurance the most.

Room Rent

Your policy will please you no end if its room rent limit is higher and you do not have to pay anything from your pocket when you are hospitalized.

Copayment

You must look for a health insurance policy wherein copayment is non-existent or minimal. For the uninitiated, copayment is what you have to pay yourself. So, if the copayment clause is 10%, it means out of 100 USD, you will have to pay 10 dollars from your own pocket.

Network Hospitals

Your health plan should have a tie-up with the hospital where you would like to get yourself treated. And if this is not possible, the network hospitals must comprise some of the top medical institutions functioning in your town.

Waiting Period

A health plan is considered a good plan when it does not have a long waiting period for pre-existing diseases.https://txmedsolutions.com/our-products/life-insurance/ There are different parameters on the basis of which you can compare the health insurance plans that are available in your area and some of them are as follows: Coverage You basically need to choose a health insurance policy that provides coverage against maximum number of medical problems. Your health plan must also consist of benefits such as cashless treatment, transportation, pre and post hospitalization charges, daycare costs, etc. Renewability When you decide to buy a health plan, you need to take note of its lifespan i.e. the number of years for which it will serve you. A health insurance policy with lifetime renewability works best for it's in your latter years that you need your health insurance the most. Room Rent Your policy will please you no end if its room rent limit is higher and you do not have to pay anything from your pocket when you are hospitalized. Copayment You must look for a health insurance policy wherein copayment is non-existent or minimal. For the uninitiated, copayment is what you have to pay yourself. So, if the copayment clause is 10%, it means out of 100 USD, you will have to pay 10 dollars from your own pocket. Network Hospitals Your health plan should have a tie-up with the hospital where you would like to get yourself treated. And if this is not possible, the network hospitals must comprise some of the top medical institutions functioning in your town. Waiting Period A health plan is considered a good plan when it does not have a long waiting period for pre-existing diseases.TXMEDSOLUTIONS.COMLife InsuranceLooking for the best Medicare Health Plans in San Antonio, TX? Texas Medicare Solutions has you covered! Call (210) 908-6565 to speak to an agent today!0 Commentarios 0 Acciones 271 Views 0 Vista previa - HOSPITAL INDEMNITY INSURANCE - Best Health Plans in TexasHow would you and your family pay bills if impacted with the high costs of deductibles, co-pays, and unexpected expenses that weren’t covered by your other insurance plans? Hospital Indemnity insurance plans can help you manage those expenses so your savings can be preserved. Benefits are paid directly to you, or a medical provider that you designate, and are paid in addition...0 Commentarios 0 Acciones 742 Views 0 Vista previa

- The best vision insurance in TexasWe all have only a set of eyes and this in itself is a solid fact to prove the importance of vision insurance. The best vision insurance in Texas can help you pay for periodic eye exams, which help diagnose and treat many eye-related problems in a timely manner. Many severe eye diseases such as diabetic eye disease, glaucoma and age-related macular degeneration present no early symptoms and can...0 Commentarios 0 Acciones 812 Views 0 Vista previa

Quizás te interese…