Highlights

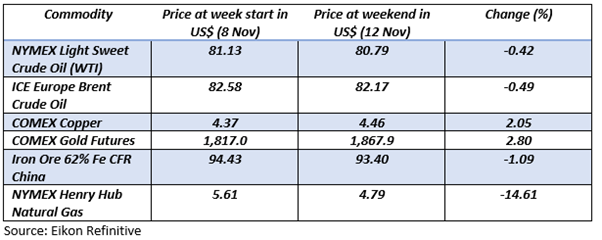

- The last week saw crude oil prices tumbling as an inflation-driven dollar rally made the commodity more expensive for other currency holders.

- The prices of precious metals rose due to the high demand for gold and silver as an inflation hedge amid the high US consumer price index.

- Iron ore tumbled last week due to its weak demand in China.

Energy prices recorded significant growth in the third quarter of 2021 and are anticipated to remain buoyed in 2022, adding to global inflationary pressure and potentially shifting economic growth to energy-exporting nations.

Some of the commodities recorded a significant surge in prices, reaching levels not seen since 2011, while others traded nearly flat. The annual inflation rate jumped to three-decade highs at 6.2% in October, bolstered by a terrific surge in energy prices.

Additionally, soaring gasoline and food prices are adding to the worries of consumers across the globe. Meanwhile, Federal Reserve Chairman Jerome Powell has assured that policymakers would wait for the ease in supply chain disruptions and the slowdown of inflation.

Given this backdrop, let's have a look at a few commodities that were popular among traders in the past week.

Crude oil

The prices of crude oil tumbled nearly 0.42% last week as an inflation-driven dollar rally made the world's largest traded commodity more expensive for other currency holders.

Additionally, a weaker oil demand forecast by OPEC and its allies has further dampened the sentiments. The cartel said in its monthly report that the oil demand is expected to hit 99.49 million barrels per day in the fourth quarter of 2021.

Source: © Batareykin | Megapixl.com

The slowdown of the global economic recovery coupled with lower demand in India and China, due to spillover effect through wider sectors of the economy, has also weighted oil prices.

Natural Gas

In the energy sector, the prices of natural gas futures dropped nearly 14.61% last week. The futures traded near US$5 per million British thermal units, a level not witnessed since 22 September as Russia started to balance the supplies by transporting gas to Europe.

The gradual return of gas flows from Russia to Europe is expected to reduce the dependency of the continent on US LNG shipments. Additionally, weekly Energy Information Administration (EIA) figures show that domestic stockpiles in the country surged by 7 billion cubic feet last week, having added 63bcf in the previous week.

Gold & Silver

Among precious metals, gold recorded notable weekly gains of 2.80% last week, with prices hitting above US$1,850 per ounce. The precious metal has been an impressive performer for the last few weeks, having moved significantly in the last one month. Additionally, the prices of silver have also surged in the last one month, with nearly 4.36% gains coming in the last week.

Rising gold and silver | Source: © Vitezslavvylicil | Megapixl.com

The significant rise in the prices of precious metals was attributed to higher demand as an inflation hedge amid a high US consumer price index.

Copper

In the base metal domain, copper prices surged nearly US$4.46 per pound on 12 November relative to its prices at the starting of the week.

The significant drop in the prices of copper was due to the slowdown of China’s manufacturing sector in October, for a second consecutive month in a row. However, the prices of the red metal recovered nearly 2.05% in the last week as the US Federal Reserve signalled no immediate hike in interest rates to sustain economic recovery.

Iron ore

Another significant player in the industrial metal group, iron ore, tumbled about 1.09% last week.

Iron ore | Source: © Tbe | Megapixl.com

The significant drop in the prices of base metal was primarily attributed to the weak demand for the metal from the biggest consumer of iron ore, China, which has imposed steel production curbs because of environmental concerns. The country is forcing steel producers to squeeze their output during the winter season ahead of Beijing's Winter Olympics.

First Published on Kalkine Media