Kraken HFT vs BingX HFT

What is Hashflow (HFT)?

Hashflow is a cutting-edge DEX that provides commission-free trades without slippage. The platform prioritizes interoperability and protection against exploitation through front-running or MEV. As a result, Hashflow is a top choice for cross-chain trading, allowing for smooth asset swapping across multiple blockchains without intermediaries or synthetic assets. Quoted prices are guaranteed and executed, ensuring a secure and efficient trading experience for users.

How does Hashflow work?

Hashflow is a commission-free, slippage-free decentralized exchange (DEX) that prioritizes cross-chain interoperability and protection from front-running or miner extractable value (MEV) exploits. The platform allows for seamless asset swapping across multiple blockchains without the need for synthetic assets or intermediaries, guaranteeing quoted price execution.

This is achieved through a hybrid on-chain/off-chain Request for Quote (RFQ) engine that sources quotes from market makers with on-chain liquidity pools. The cryptographically signed quotes provide users with unalterable, fixed prices, ensuring protection against MEV exploitation.

Additionally, Hashflow safeguards traders from slippage resulting from cross-chain MEV by mitigating price fluctuations during transaction validation and execution.

What is the HFT token?

HFT (High-Frequency Token) is the key token in the Hashflow ecosystem, serving as the currency for both the Hashflow protocol and the gamified governance platform, known as Hashverse. By holding and staking HFT, users can unlock a range of benefits and features within the Hashflow platform.

Buying Hashflow on Kraken vs BingX

Trading Fees

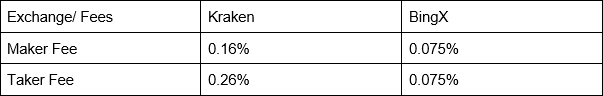

Cryptocurrency trading takes place on exchanges similar to stock exchanges, but specifically for digital currencies. The fees charged by these exchanges often vary based on a user's monthly trading volume, with some offering discounts for high-volume traders or token holders.

Kraken has a fee structure of 0.16% for makers and 0.26% for takers on most trades, with discounts for large volume traders and holders of the exchange's native token (XBT). BingX, on the other hand, has a fee of 0.075% for both makers and takers on most trades. To maximize profits, it's crucial for traders to understand these fees and the structure of each exchange.

Fee comparison table:

Exchange/ Fees

Kraken

BingX

Maker Fee

0.16%

0.075%

Taker Fee

0.26%

0.075%

Fees are subject to change, so it's important to check the current fee schedule before using an exchange.

Services and Features Offered

Kraken is a cryptocurrency exchange that provides a trading platform for buying bitcoin using fiat currency. It has a 24-hour trading volume of over $1 billion and supports the exchange of 49 cryptocurrencies with a trading fee of 0.26%, lower than Coinbase's 3.66%. Despite its lower fees, Kraken is known for its slower customer support and previous market pin issues. Some negative reviews are related to the mandatory account verification required to comply with US laws. Aimed at traders without crypto trading experience, Kraken offers a maximum leverage of 5X for margin trading.

On the other hand, BingX is an international digital financial institution operating in countries such as North America, Canada, the EU, Hong Kong, and Taiwan. BingX offers financial services including lending, borrowing, staking, and buying and selling of cryptocurrencies. It also has a referral program, a trading competition, and a copy trading feature that enables users, who may lack time or experience, to follow their chosen trader's trades.

In conclusion, both Kraken and BingX have unique features and services, and the choice between them will depend on the user's specific needs and preferences. It is important to thoroughly research both platforms and seek advice from financial advisors before making any investment decisions.

#bingx

#crypto

#bitcoin

#btc

What is Hashflow (HFT)?

Hashflow is a cutting-edge DEX that provides commission-free trades without slippage. The platform prioritizes interoperability and protection against exploitation through front-running or MEV. As a result, Hashflow is a top choice for cross-chain trading, allowing for smooth asset swapping across multiple blockchains without intermediaries or synthetic assets. Quoted prices are guaranteed and executed, ensuring a secure and efficient trading experience for users.

How does Hashflow work?

Hashflow is a commission-free, slippage-free decentralized exchange (DEX) that prioritizes cross-chain interoperability and protection from front-running or miner extractable value (MEV) exploits. The platform allows for seamless asset swapping across multiple blockchains without the need for synthetic assets or intermediaries, guaranteeing quoted price execution.

This is achieved through a hybrid on-chain/off-chain Request for Quote (RFQ) engine that sources quotes from market makers with on-chain liquidity pools. The cryptographically signed quotes provide users with unalterable, fixed prices, ensuring protection against MEV exploitation.

Additionally, Hashflow safeguards traders from slippage resulting from cross-chain MEV by mitigating price fluctuations during transaction validation and execution.

What is the HFT token?

HFT (High-Frequency Token) is the key token in the Hashflow ecosystem, serving as the currency for both the Hashflow protocol and the gamified governance platform, known as Hashverse. By holding and staking HFT, users can unlock a range of benefits and features within the Hashflow platform.

Buying Hashflow on Kraken vs BingX

Trading Fees

Cryptocurrency trading takes place on exchanges similar to stock exchanges, but specifically for digital currencies. The fees charged by these exchanges often vary based on a user's monthly trading volume, with some offering discounts for high-volume traders or token holders.

Kraken has a fee structure of 0.16% for makers and 0.26% for takers on most trades, with discounts for large volume traders and holders of the exchange's native token (XBT). BingX, on the other hand, has a fee of 0.075% for both makers and takers on most trades. To maximize profits, it's crucial for traders to understand these fees and the structure of each exchange.

Fee comparison table:

Exchange/ Fees

Kraken

BingX

Maker Fee

0.16%

0.075%

Taker Fee

0.26%

0.075%

Fees are subject to change, so it's important to check the current fee schedule before using an exchange.

Services and Features Offered

Kraken is a cryptocurrency exchange that provides a trading platform for buying bitcoin using fiat currency. It has a 24-hour trading volume of over $1 billion and supports the exchange of 49 cryptocurrencies with a trading fee of 0.26%, lower than Coinbase's 3.66%. Despite its lower fees, Kraken is known for its slower customer support and previous market pin issues. Some negative reviews are related to the mandatory account verification required to comply with US laws. Aimed at traders without crypto trading experience, Kraken offers a maximum leverage of 5X for margin trading.

On the other hand, BingX is an international digital financial institution operating in countries such as North America, Canada, the EU, Hong Kong, and Taiwan. BingX offers financial services including lending, borrowing, staking, and buying and selling of cryptocurrencies. It also has a referral program, a trading competition, and a copy trading feature that enables users, who may lack time or experience, to follow their chosen trader's trades.

In conclusion, both Kraken and BingX have unique features and services, and the choice between them will depend on the user's specific needs and preferences. It is important to thoroughly research both platforms and seek advice from financial advisors before making any investment decisions.

#bingx

#crypto

#bitcoin

#btc

Kraken HFT vs BingX HFT

What is Hashflow (HFT)?

Hashflow is a cutting-edge DEX that provides commission-free trades without slippage. The platform prioritizes interoperability and protection against exploitation through front-running or MEV. As a result, Hashflow is a top choice for cross-chain trading, allowing for smooth asset swapping across multiple blockchains without intermediaries or synthetic assets. Quoted prices are guaranteed and executed, ensuring a secure and efficient trading experience for users.

How does Hashflow work?

Hashflow is a commission-free, slippage-free decentralized exchange (DEX) that prioritizes cross-chain interoperability and protection from front-running or miner extractable value (MEV) exploits. The platform allows for seamless asset swapping across multiple blockchains without the need for synthetic assets or intermediaries, guaranteeing quoted price execution.

This is achieved through a hybrid on-chain/off-chain Request for Quote (RFQ) engine that sources quotes from market makers with on-chain liquidity pools. The cryptographically signed quotes provide users with unalterable, fixed prices, ensuring protection against MEV exploitation.

Additionally, Hashflow safeguards traders from slippage resulting from cross-chain MEV by mitigating price fluctuations during transaction validation and execution.

What is the HFT token?

HFT (High-Frequency Token) is the key token in the Hashflow ecosystem, serving as the currency for both the Hashflow protocol and the gamified governance platform, known as Hashverse. By holding and staking HFT, users can unlock a range of benefits and features within the Hashflow platform.

Buying Hashflow on Kraken vs BingX

Trading Fees

Cryptocurrency trading takes place on exchanges similar to stock exchanges, but specifically for digital currencies. The fees charged by these exchanges often vary based on a user's monthly trading volume, with some offering discounts for high-volume traders or token holders.

Kraken has a fee structure of 0.16% for makers and 0.26% for takers on most trades, with discounts for large volume traders and holders of the exchange's native token (XBT). BingX, on the other hand, has a fee of 0.075% for both makers and takers on most trades. To maximize profits, it's crucial for traders to understand these fees and the structure of each exchange.

Fee comparison table:

Exchange/ Fees

Kraken

BingX

Maker Fee

0.16%

0.075%

Taker Fee

0.26%

0.075%

Fees are subject to change, so it's important to check the current fee schedule before using an exchange.

Services and Features Offered

Kraken is a cryptocurrency exchange that provides a trading platform for buying bitcoin using fiat currency. It has a 24-hour trading volume of over $1 billion and supports the exchange of 49 cryptocurrencies with a trading fee of 0.26%, lower than Coinbase's 3.66%. Despite its lower fees, Kraken is known for its slower customer support and previous market pin issues. Some negative reviews are related to the mandatory account verification required to comply with US laws. Aimed at traders without crypto trading experience, Kraken offers a maximum leverage of 5X for margin trading.

On the other hand, BingX is an international digital financial institution operating in countries such as North America, Canada, the EU, Hong Kong, and Taiwan. BingX offers financial services including lending, borrowing, staking, and buying and selling of cryptocurrencies. It also has a referral program, a trading competition, and a copy trading feature that enables users, who may lack time or experience, to follow their chosen trader's trades.

In conclusion, both Kraken and BingX have unique features and services, and the choice between them will depend on the user's specific needs and preferences. It is important to thoroughly research both platforms and seek advice from financial advisors before making any investment decisions.

#bingx

#crypto

#bitcoin

#btc

0 Comments

0 Shares

1058 Views

0 Reviews